U.S. container ports are headed into their winter lull as holiday season nears the finish line and retail imports continue to wind down, the National Retail Federation said Wednesday.

An earlier than normal holiday shipping season this year means most holiday merchandise is already on store shelves or in warehouses, resulting in December cargo volumes at the nation’s major container ports that are likely to be significantly below records set earlier this year, the NRF said in its monthly Global Port Tracker report.

“Retailers are in the middle of the annual holiday frenzy but ports are headed into their winter lull after one of the busiest and most challenging years we’ve ever seen,” said NRF Vice President for Supply Chain and Customs Policy Jonathan Gold.

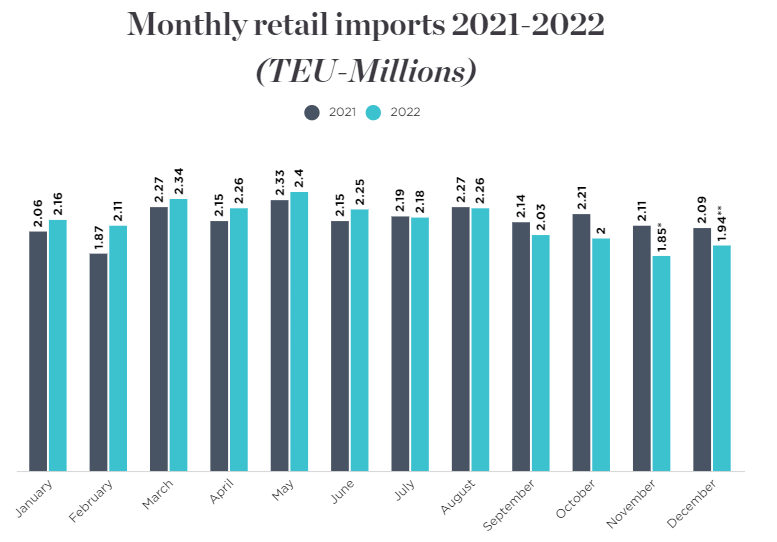

Monthly retail imports repeatedly broke records this spring and hit a new all-time high of 2.4 million TEUs in May as worries about potential West Coast disruption led many retailers to bring in cargo early this spring, and also prompted a shift to East Coast and Gulf Coast ports. But imports have been slowing since August, a few months earlier than normal, as retailers felt sufficiently stocked for what is shaping up to be a record-breaking holiday shopping season.

With President Biden last week signed legislation imposing a labor agreement on freight railroads and unions, averting a potentially catastrophic strike that could have come this week. While contract negotiations are on-going for more than 22,000 West Coast dockworkers, some expect a deal to be reached sometime early next year without any disruption to the supply chain.

“We’ve dodged a rail strike and the retail supply chain should be able to easily handle the remaining weeks of the holiday season. But it’s time to settle on a labor contract for West Coast ports and address other supply chain issues that remain so the lull doesn’t become the calm before a storm,” Gold said.

Ben Hackett, founder of Hackett Associates which produces the Global Ports Tracker for the NRF, said current lower imports are the result of retailers balancing inventory built up earlier against slowing consumer demand and expectations for 2023.

“Key indicators point the way to a robust economy,” Hackett said. “Yet the volume of imported container cargo at the ports we cover has declined, and the next six months will see further declines to a level not seen for some time.”

U.S. ports covered by Global Port Tracker handled 2 million TEU in October, the latest month for which final numbers are available. That was down 1.3% from September and down 9.3% from October 2021. While ports have not yet reported November’s numbers, the Global Port Tracker is projected 1.85 million TEUs, which would be down 12.3% year over year and the lowest since February 2021. December is forecast at 1.94 million TEU, down 7.2% year over year.

Source: NRF/Hackett Associates Global Port

Despite the second half slowdown, 2022 is likely to come in just slightly below last year’s record for retail imports. The projected numbers would bring 2022 to 25.81 million TEU, down just 0.1% from last year’s annual record of 25.84 million TEU.

Looking into next year, January is forecast at 1.97 million TEU, down 8.8% yoy; February is forecast at 1.67 million TEU, the lowest since 1.61 million TEU in June 2020 and a 20.9% drop from last year, partly because backlogs kept ports through the historically slow season. The Global Port Tracker is projecting March at 1.91 million TEU, down 18.6% year-over-year, and April at 1.95 million, down 13.8%. It will be interesting to revisit these projections in the months ahead as the situation evolves.